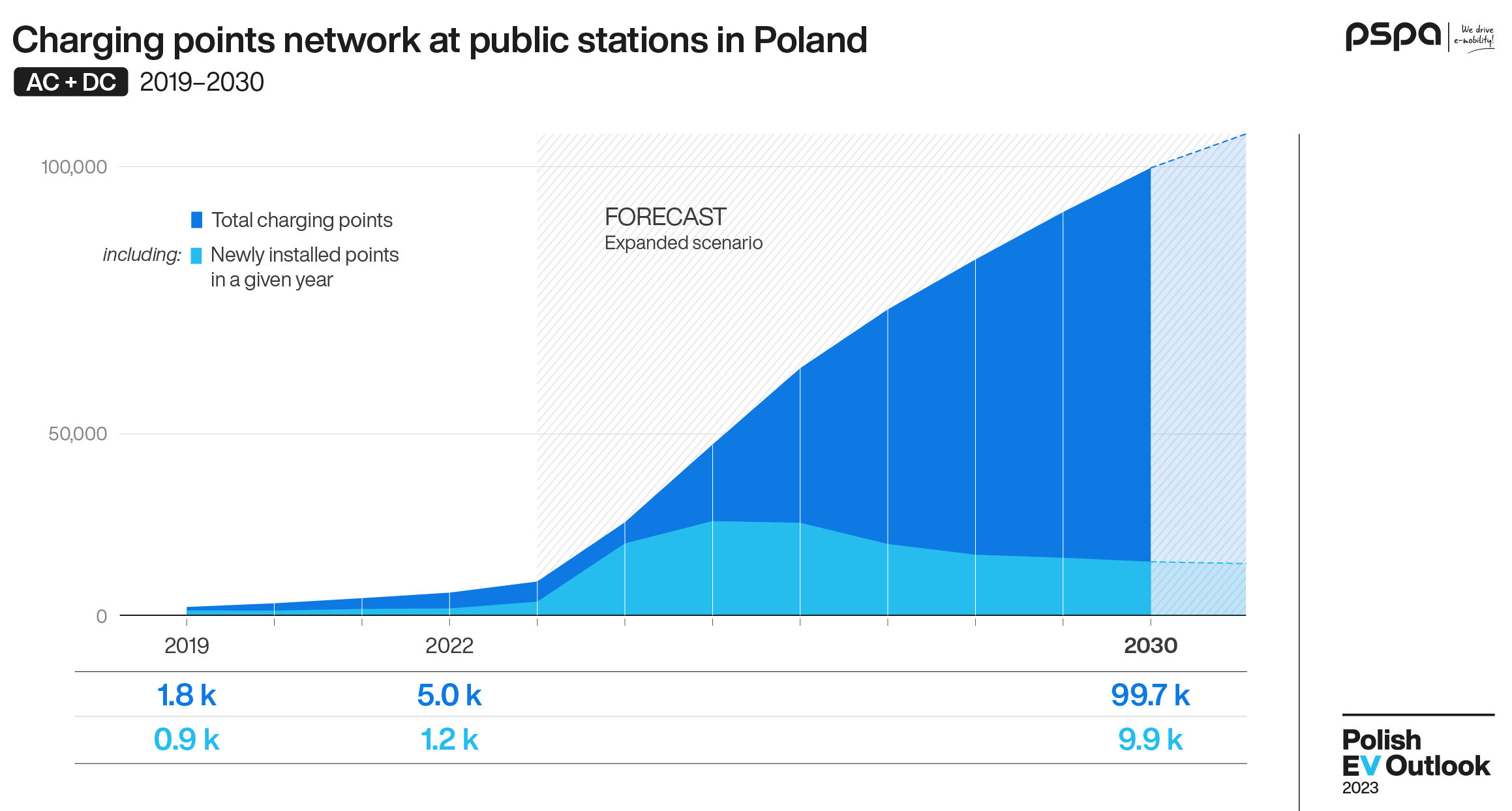

The public charging infrastructure network in Poland is poised for significant expansion, with plans to increase the number of charging points from approximately 5,000 at present to almost 100,000 by 2030. The “Polish EV Outlook 2023” report suggests that within three years, the annual installation of new chargers could exceed ten times the current rate seen in 2022. The latest edition of PSPA’s periodic study features market development forecasts and hitherto unpublished data on the utilization rate of stations in Poland, gathered through interviews with leading public infrastructure operators.

The “Polish EV Outlook 2023” report offers a detailed overview of the current state and future projections for the Polish market of zero- and low-emission transport, spanning almost 300 pages. A prominent feature of the report is a thorough analysis of the public charging infrastructure sector, covering several aspects such as the current state of network expansion, favored locations and manufacturers among major operators, charger capacity and accessibility, infrastructure distribution in various cities and voivodeships, market share of key stakeholders, and compliance of individual municipalities with their responsibilities outlined in the Act on Electromobility and Alternative Fuels.

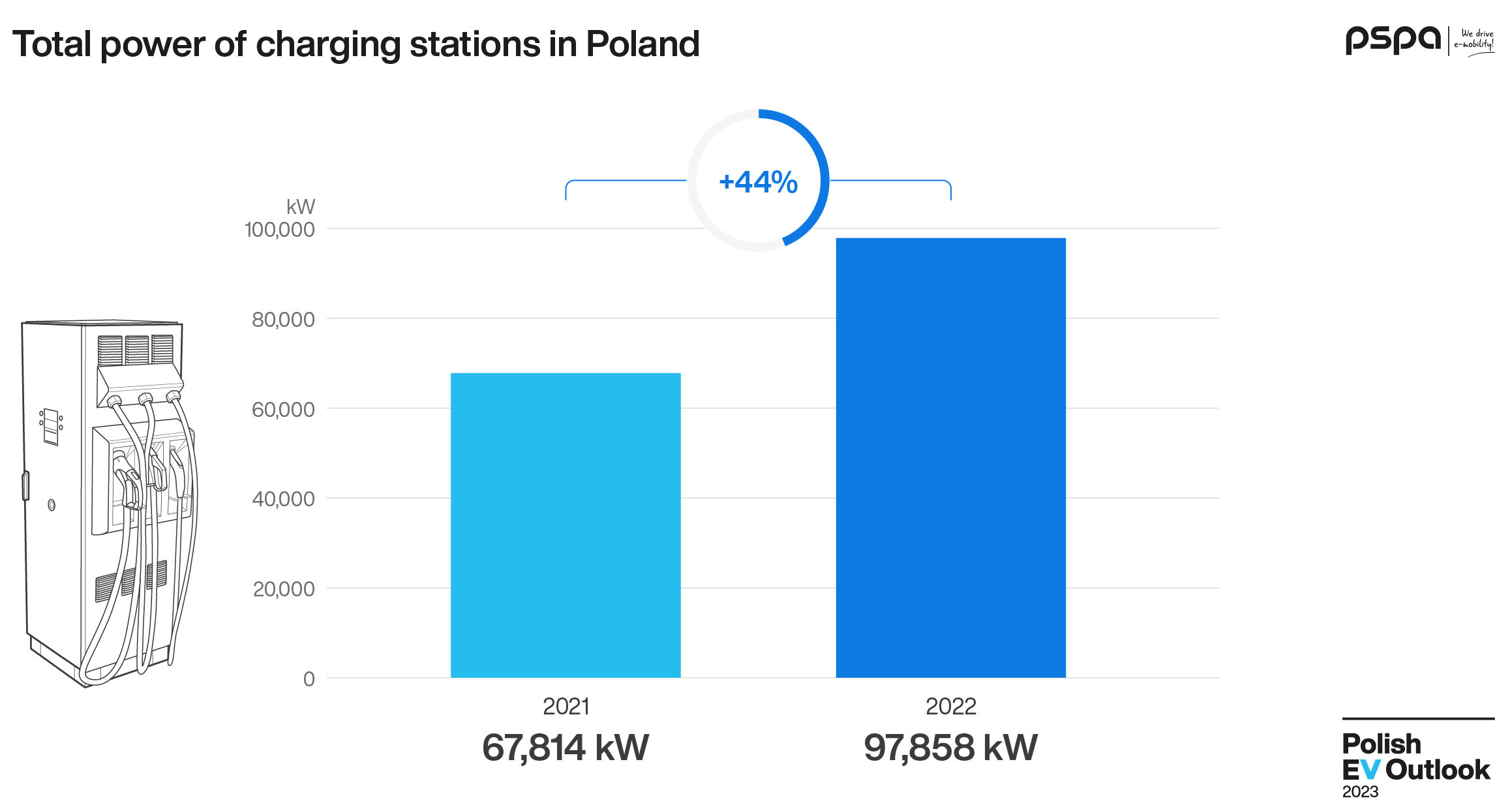

In 2022, the total number of public charging stations in Poland witnessed an increase of almost 30%, marking a significantly higher growth rate than that of 2021. The installation of 633 new chargers contributed to this growth. Notably, the number of fast charging stations, i.e., those with a capacity of over 50 kW, has been on a steady rise. The percentage of such chargers in the Polish network rose from 8% in 2021 to 11% in 2022. This expansion of DC stations has resulted in an overall increase in the total capacity of operational infrastructure in Poland. The capacity increased by as much as 44% in 2022 alone, from approximately 68 to 98 MW – says Jan Wiśniewski, Head of PSPA Research and Analysis Centre.

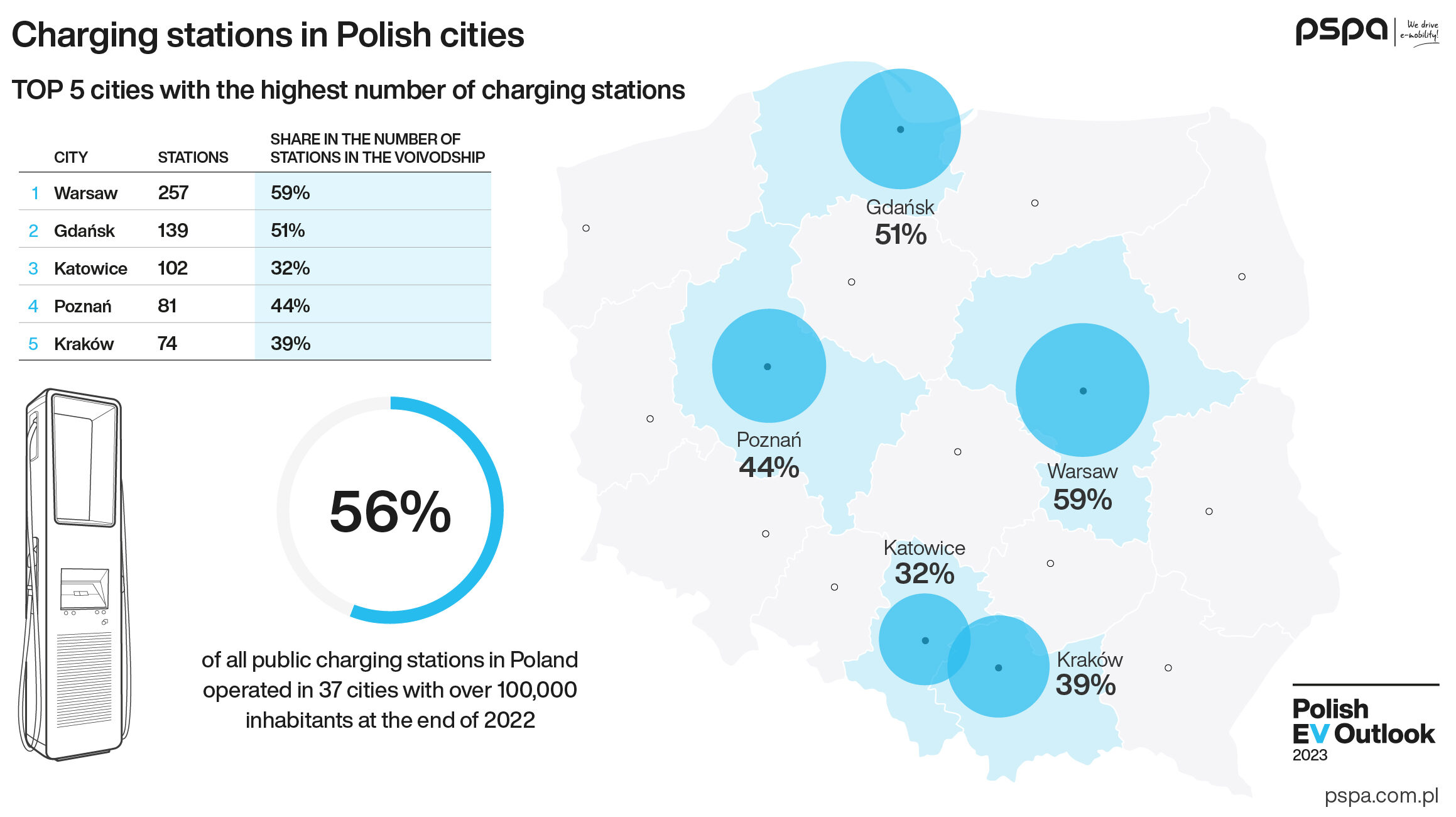

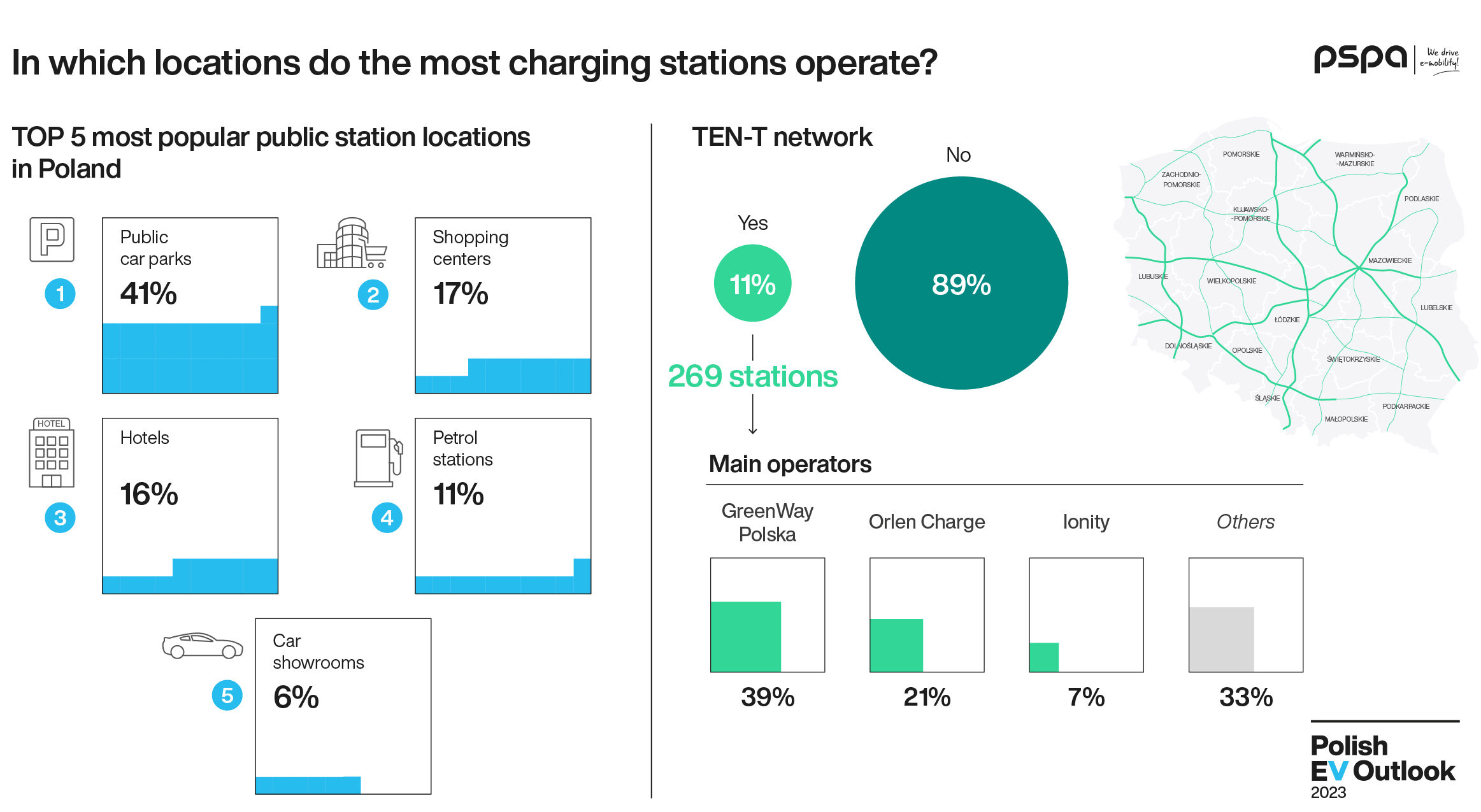

According to the latest edition of the “Polish EV Outlook” report, 92% of public chargers in Poland require a fee for usage. Additionally, the concentration of infrastructure within the network of 13 prominent operators is steadily increasing, with these operators accounting for almost 70% of all public chargers in Poland. As of the end of 2022, GreenWay Polska held the highest market share of 19.4%, followed by Orlen Charge, Tauron, Noxo, and EV+. Furthermore, operators are increasingly depending on HUBs, which are locations with multiple charging stations. Almost 30% of Polish locations now have at least two chargers installed. When considering the most popular public station manufacturers, Delta has the highest market share in Poland at 27%, followed by Ekoenergetyka and Efacec in second and third place, respectively. However, the distribution of charging infrastructure in Poland remains uneven, with more than half of all charging stations (56%) located in cities with a population exceeding 100,000.

– The ranking of cities with the largest number of chargers is topped by Warsaw. The runners up are: Gdańsk, Katowice, Kraków and Szczecin. However, in the capital city, there are significantly more BEVs per charging point, with a ratio of as many as 16. In contrast, in urban centres such as Dąbrowa Górnicza, Koszalin, Płock, Sosnowiec and Włocławek, this ratio is 1:1. In terms of provinces, the largest number of public charging stations is located in the Masovian, Silesian, Pomeranian, Lower Silesian and Lesser Poland Voivodeships. The fewest are in the Świętokrzyskie, Lublin, Podlaskie and Lubusz Voivodeships. The highest increase in new stations in H2 2022 was recorded in the West Pomeranian Voivodeship – by 33%, says Albert Kania, PSPA Senior New Mobility Manager.

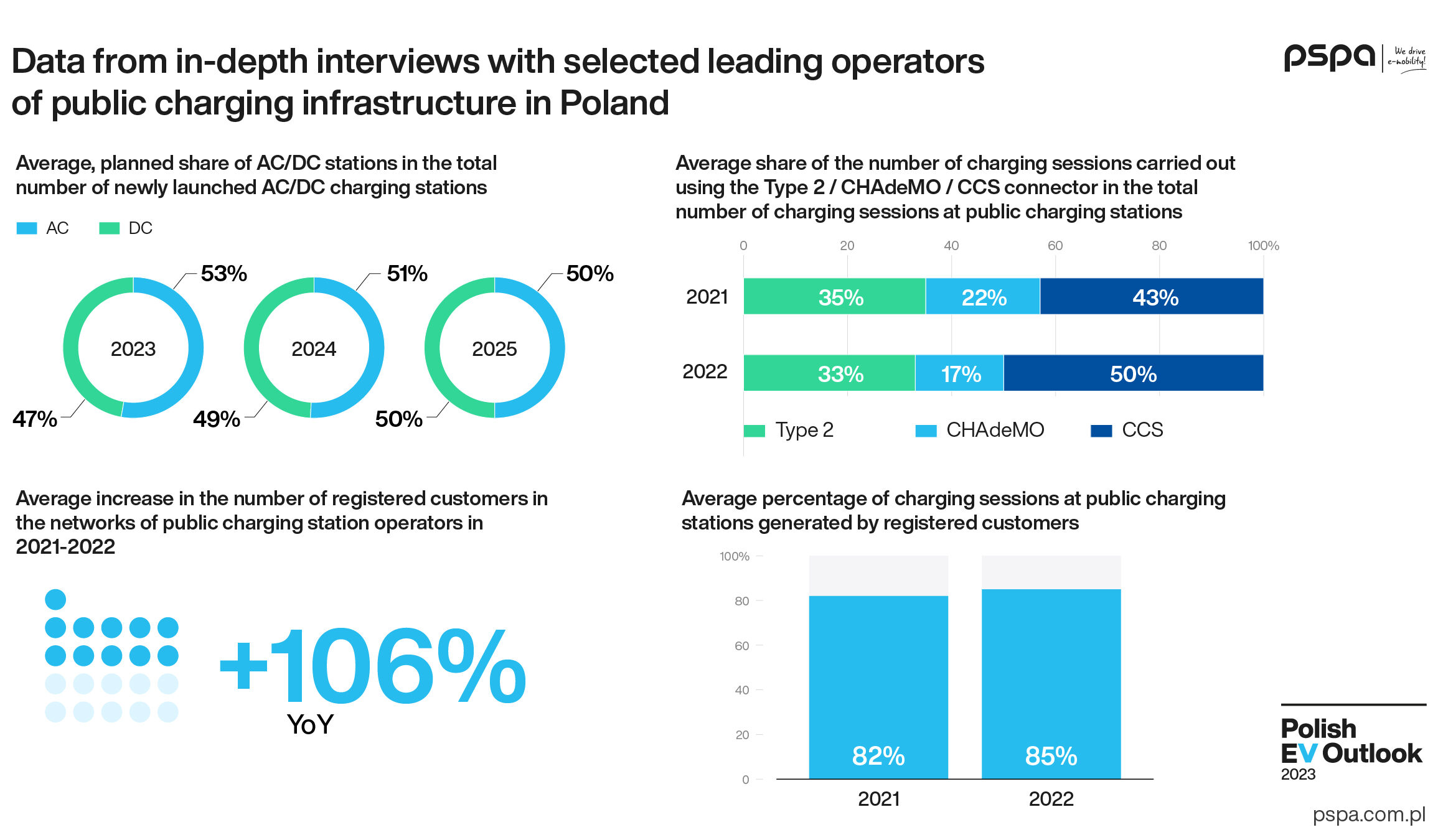

41% of public charging stations are located in public car parks, 17% in shopping centers, 16% in hotels, and 11% at petrol stations. Additionally, 95% of charging stations in Poland are open 24 hours a day, and 11% of DC stations are located within the TEN-T network. The latest edition of “Polish EV Outlook” provides unique insights into the use of charging infrastructure in Poland, including the preferences of EV drivers. The data collected through in-depth interviews with selected leading operators of public charging stations in Poland reveals that market participants are primarily focused on launching DC charging stations. By 2025, fast chargers are expected to make up half of the total deployment of public charging infrastructure. As a result, the scale of investment in DC stations is projected to be significantly higher than in AC devices.

– The data obtained from the operators correspond to current trends in the e-mobility sector and confirm the steadily increasing popularity of the CCS standard in relation to CHAdeMO among BEV drivers. In 2022, more than half of all charging sessions at public stations were carried out using the former type of connector. “Polish EV Outlook 2023” also shows that there is a steady increase in the number of customers registered with the networks of the leading operators. In 2022, the average growth in this area was 106% YoY – says Jan Wiśniewski.

“Polish EV Outlook 2023” presents two potential scenarios for the expansion of public charging points in Poland. These scenarios consider a range of variables and key trends, including technological advancements, market changes, and political factors such as EU-led initiatives to support public charging infrastructure in Member States, the evolving EV charging habits of drivers, the growing range of electric vehicles, and the entrance of large operators with foreign capital – primarily international oil companies – into the Polish market.

– The rate of infrastructure development in Poland in the coming years will depend primarily on measures taken by the public administration, regardless of European trends. The industry has already put relevant plans in place, but it is crucial to ensure that imperfect legislation and lengthy procedures do not hinder their implementation. This is in the interest of all, as slow development of the charging network could subject Poland to significant financial penalties in connection with the AFIR regulation, which sets the first deadline for meeting infrastructure obligations in less than three years. With the implementation of optimization measures, we predict that the number of newly installed charging points in Poland could increase more than tenfold by 2025, reaching over 17,000. This would result in a network of over 99,700 public charging points in our country by 2030. Without the necessary changes, the pace of station development will be delayed for several months – says Maciej Mazur, PSPA Managing Director.

In addition to data on the charging infrastructure sector, “Polish EV Outlook 2023” offers a comprehensive analysis of the passenger and commercial EV (BEV and PHEV) market in Poland, including a forecast of its development until 2040 in three different scenarios. The report also provides a detailed description of the e-mobility segment’s model offerings and the latest legal regulations shaping the Polish e-mobility market. Additionally, the report includes a forecast of energy demand growth associated with e-mobility’s development. This year’s edition of the report stands out with its first-ever development forecast of the zero-emission heavy-duty road transport market in Poland. Readers of the report can learn about the key factors crucial for accelerating the pace of truck fleet electrification in Poland and how many eHDVs will be on Polish roads by 2040.

More information about the “Polish EV Outlook 2023”, as well as the possibility of ordering the report: Polishevoutlook.pl