-

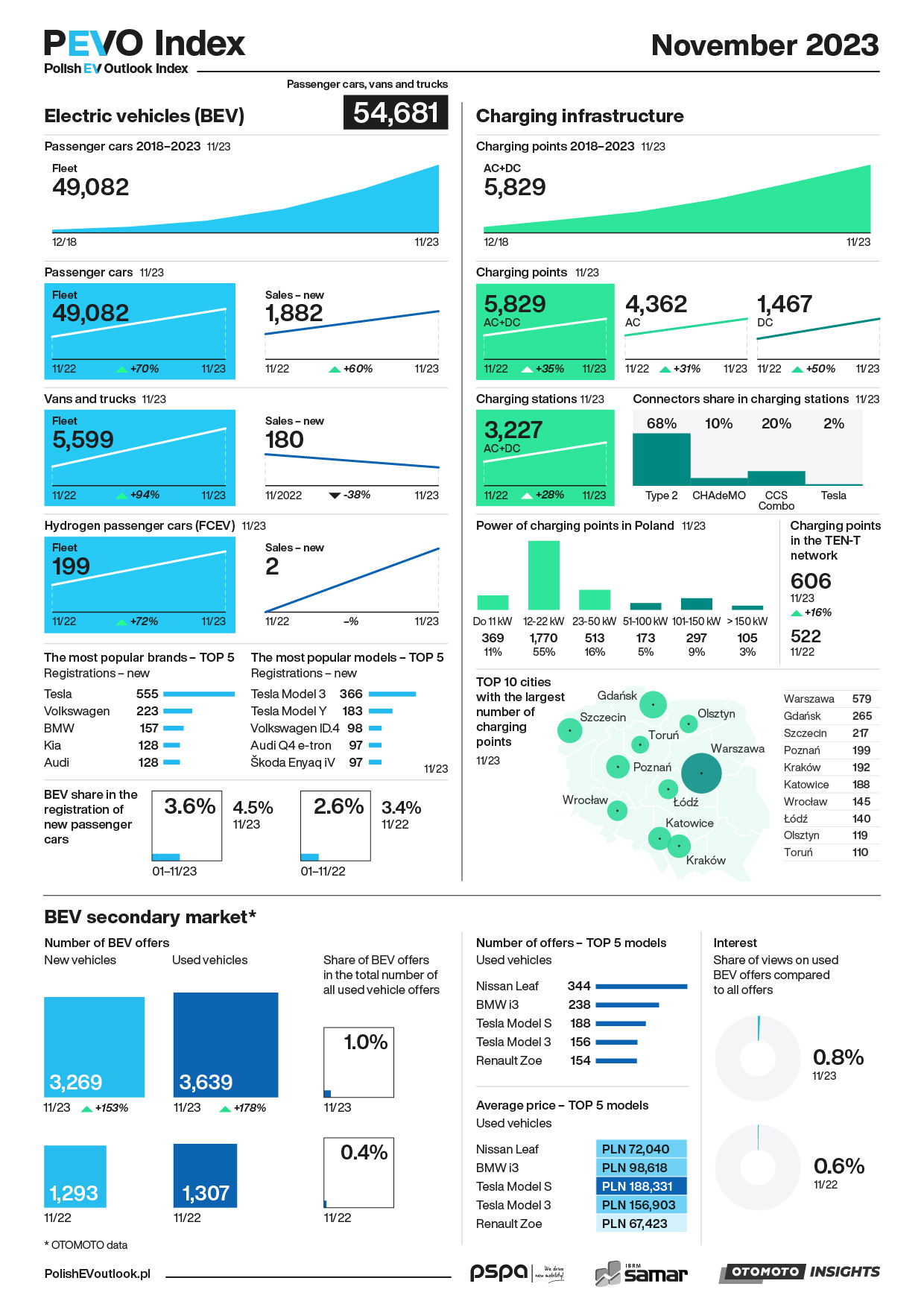

Almost 1.9 thousand new battery-electric passenger cars (BEV) were registered in November 2023 in Poland.

-

Among Polish cities, the largest number of charging points operate in Warsaw (579), Gdańsk and Poznań.

-

At the same time, in the last year the number of offers for used zero-emission vehicles has increased almost three times.

-

Polish EV Outlook Index (PEVO Index) is a cyclical summary of statistics and trends in the e-mobility sector in Poland.

“Polish EV Outlook” is the most important, most comprehensive analysis of the zero-emission transport market in Poland. For 5 years, PSPA has been presenting in its report on over 320 pages a cross-sectional picture of the market for passenger cars, delivery vans and trucks of electric cars, charging infrastructure, the structure of EV buyers, legislative changes and the impact of e-mobility on the electricity sector. Now “Polish EV Outlook” debuts in a completely new version. Thanks to the cooperation of PSPA, IBRM Samar and OTOMOTO, the “PEVO Index” was created – a cyclical, monthly version of “Polish EV Outlook” containing regularly updated key data included in the full version of the report, presented in an accessible, infographic form.

– “PEVO Index” is a completely new, unique project. Our ambition was to collect the most important data on e-mobility in one place, both from the perspective of the industry and all other people interested in the development of the electromobility market in Poland. From now on, we intend to publish monthly updated detailed information on the market for new passenger cars, delivery vans and trucks, as well as charging infrastructure. Comprehensive data on used zero-emission vehicles is also completely new in the Polish media space. In practice, the “PEVO Index” is a monthly summary of the most important information contained in the full version of the “Polish EV Outlook” report – says Maciej Mazur, Managing Director of PSPA.

What does the first edition of the “PEVO Index” show?

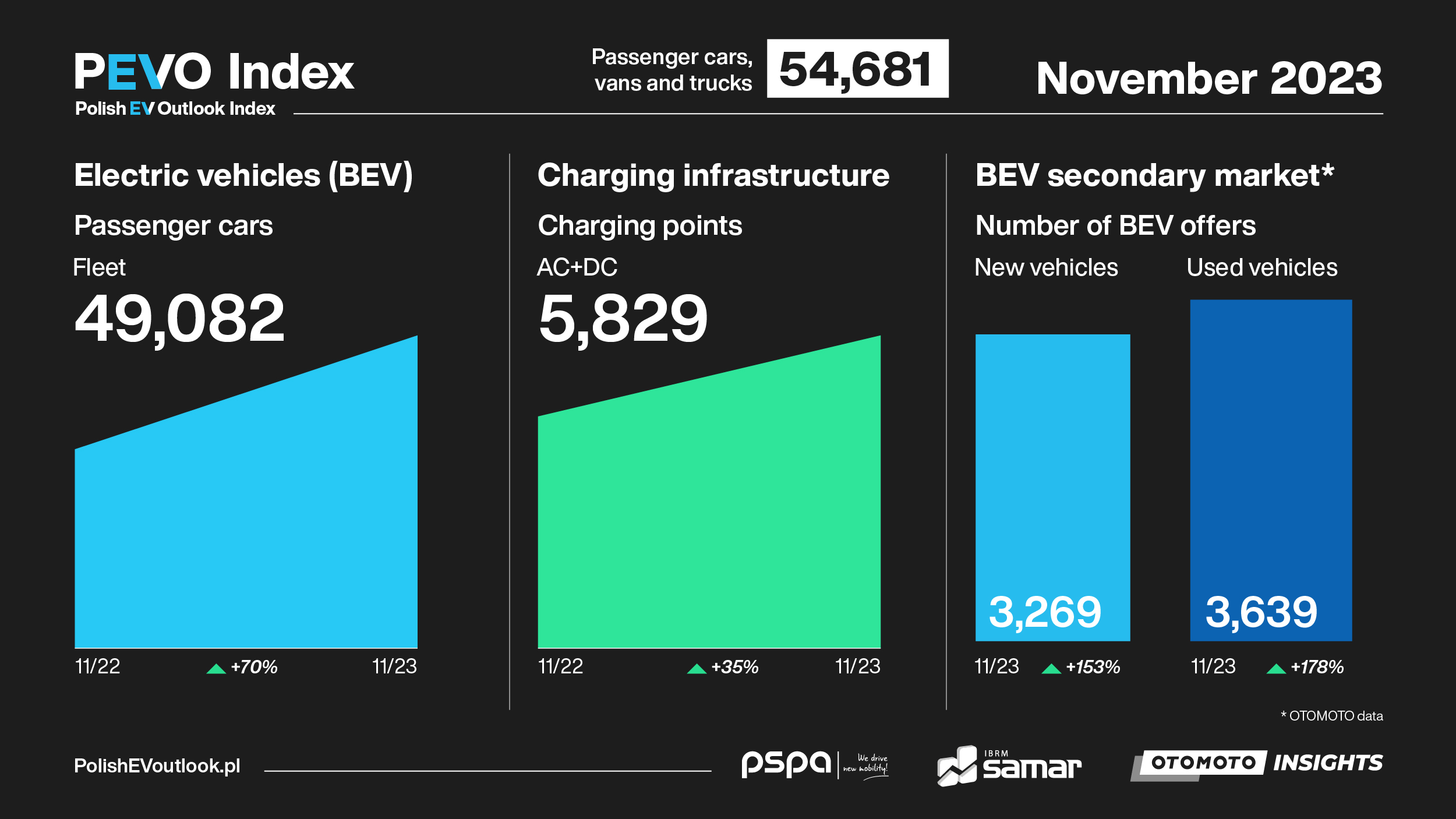

In November 2023, the fleet of passenger cars, delivery vans and trucks all-electric (BEV) in Poland numbered 54,681 units. The fleet of BEV passenger cars consisted of 49,082 units (+70% y/y), and the number of registrations of new vehicles of this type in November 2023 it amounted to 1,882 pieces (+60% y/y). Very dynamic growth was recorded in the segment of fully electric delivery vehicles and trucks. In November, their park increased to 5,599 units (+94% y/y).

– I am glad that IBRM Samar is participating in the PEVO Index project. The presentation of reliable data plays an important role in analyzing ongoing changes and predicting the future. Electromobility is the direction we are heading in, so it is worth knowing where we are today and what potentially awaits us. The challenges are great and do not only concern the available offer compared to the content of our portfolio, as well as the still poor infrastructure, but above all, providing strong arguments and highlighting the benefits that will convince people that the adopted direction is good. Preparing the PEVO Index is part of the path we must cover and which will lead us to the ultimate goal of “clean” mobility – says Wojciech Drzewiecki, President of the SAMAR Automotive Market Research Institute.

The most popular new passenger BEV models in November were Tesla Model 3 (366 units sold), Tesla Model Y (183 units) and Volkswagen ID.4 (98 units). The brands on the podium included Tesla, Volkswagen and BMW. The share of BEVs in the new passenger car market was 4.5% in November. Hydrogen vehicles (FCEV) still constitute a market niche in Poland. The passenger FCEV fleet consists of 199 units.

– A clear increase over the last 12 months has also been recorded in the infrastructure sector. The number of charging points increased by over 1.5 thousand. In total, there are 5,829 (+35% y/y) public points in Poland, including 4,362 AC (+31% y/y) and 1,467 DC (+50% y/y)/. Chargers with a power of up to 22 kW have the largest share in the charging infrastructure network in Poland (66%), but the number of fast DC stations with a power exceeding 50 kW is growing very dynamically. EV drivers can already use 575 such devices in Poland. This is almost 1/5 of the total number of publicly available chargers in our country – says Jan Wiśniewski, Director of the PSPA Research and Analysis Center.

The “PEVO Index” also contains information on cities with the best-developed infrastructure for zero-emission vehicles. The first is Warsaw (579 points in November 2023), followed by Gdańsk (265), Szczecin (217), Poznań (199) and Kraków (192). Another very important information included in the PEVO Index is the number of points along the TEN-T network (606 in November, which means an increase of 16% y/y). It is this factor that determines the comfort of traveling in an EV on longer routes in Poland.

Thanks to the “PEVO Index”, you can also easily obtain data on the offer on the electromobility secondary market in our country. In November 2023, the number of ads for used BEVs on the OTOMOTO portal was 3,639. This is an increase of 178% y/y. Despite this, the share of all-electric car ads in the total number of used vehicle ads is still low – 1.0%. As a result, interest in EVs from the secondary market is still low – such offers account for only 0.8% of all ad views on the OTOMOTO portal.

– The number of advertisements for the sale of used electric cars is growing spectacularly year on year, but we must remember that a low base value is key here. Electric cars are relatively young on the market – especially if we compare their age to the average of the entire car fleet in Poland, which has already exceeded 14 years. Observing the market and the pace of registration of new electric cars, we anticipate that a clear wave of interest will also appear in the used BEV car segment and I am very glad that by following subsequent updates of the PEVO Index, we will be able to refer to this topic on an ongoing basis – says Agnieszka Czajka, General Manager of OTOMOTO .

The most popular BEV models on the e-mobility secondary market in Poland are Nissan Leaf (344 ads in November 2023 with an average price of PLN 72,040), BMW i3 (238 ads with an average price of PLN 98,618) and Tesla Model S (188 ads with average price PLN 188,331).

Data for the “PEVO Index” are provided by: PSPA, IBRM Samar and OTOMOTO.

More information about the full version of the “Polish EV Outlook” report is available at:

Polishevoutlook.pl