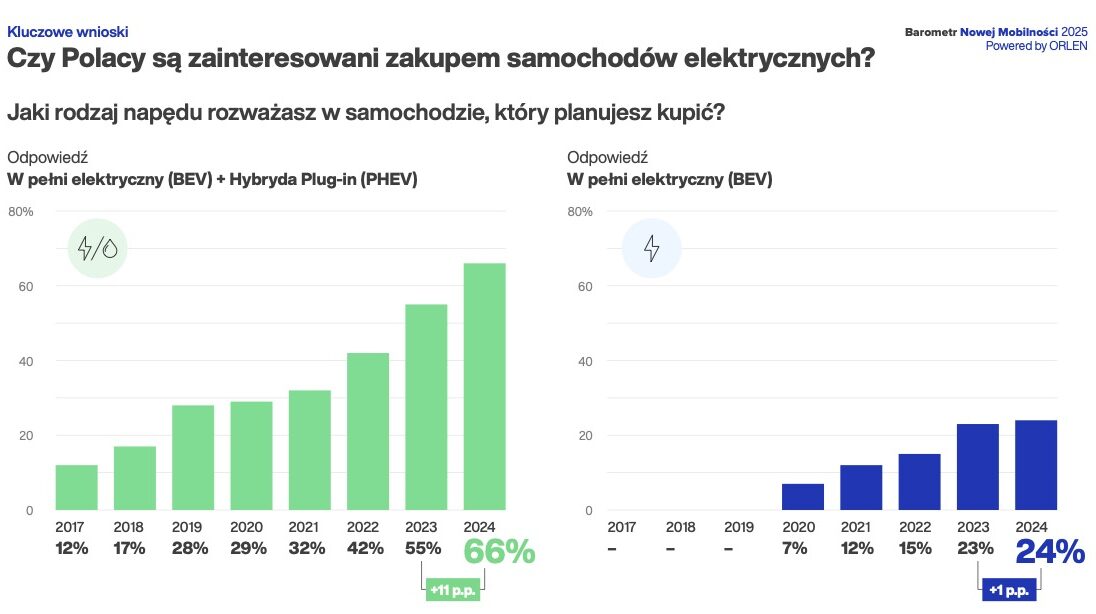

Over the past four years, the number of Poles considering the purchase of an electric car has more than tripled (from 7% to 24%)—according to the eighth edition of the New Mobility Barometer powered by ORLEN 2025, a recurring public opinion survey illustrating the changes in the domestic new mobility market since 2017. At the same time, however, 37% of those interested in buying a new car will not choose an electric vehicle due to its price.

According to the latest edition of the New Mobility Barometer powered by ORLEN, prepared by PSNM, interest in electric cars has more than tripled. In 2020, 7% of respondents were considering purchasing a BEV; in 2021 – 12%; in 2022 – 15%; in 2023 – 23%; and in 2024 – 24%.

– As many as 11% of respondents considering the purchase of a brand-new car are convinced that within three years they will decide to buy a fully electric vehicle. However, it should be noted that compared to the European average, where BEV registrations currently account for around 14%, Poland would still lag behind most member states even with this rate – says Albert Kania, Chief Operating Officer at F5A New Mobility Research and Consulting.

How much should electric cars cost to be attractive for Poles?

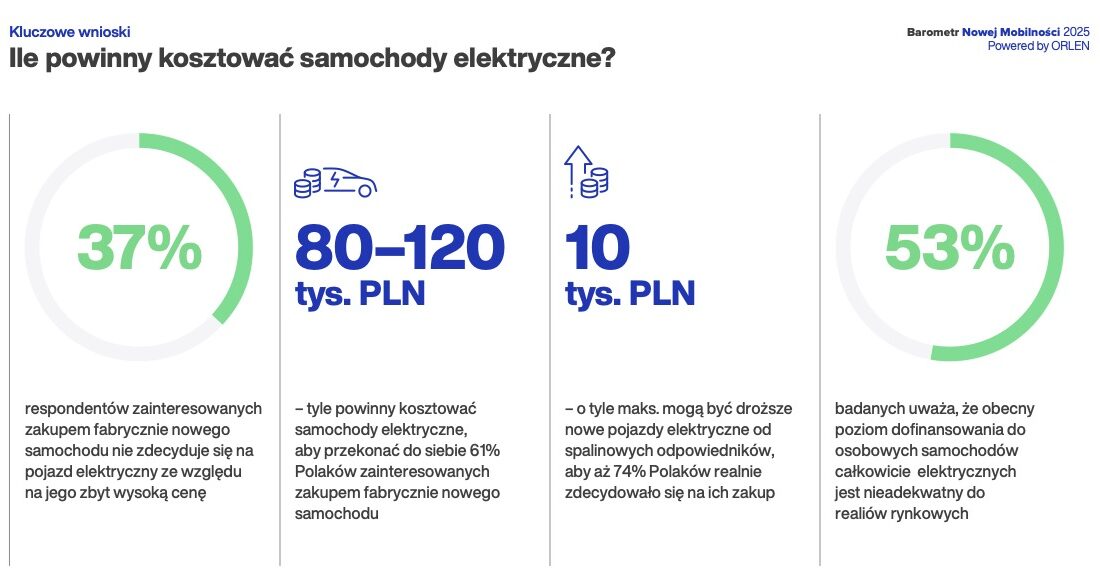

The main barrier preventing Poles from buying electric cars is their price. Interestingly, Poles indicate that they are willing to pay more for an electric version of the same model than for a combustion-engine one. The key question, then, is: how much more?

– As many as 74% of respondents emphasize that they might consider switching to electric drive if the cost of such vehicles were at most 10,000 PLN higher than their combustion-engine counterparts. At the same time, 53% of respondents believe that the current level of subsidies for passenger electric cars is inadequate for market realities – adds Albert Kania.

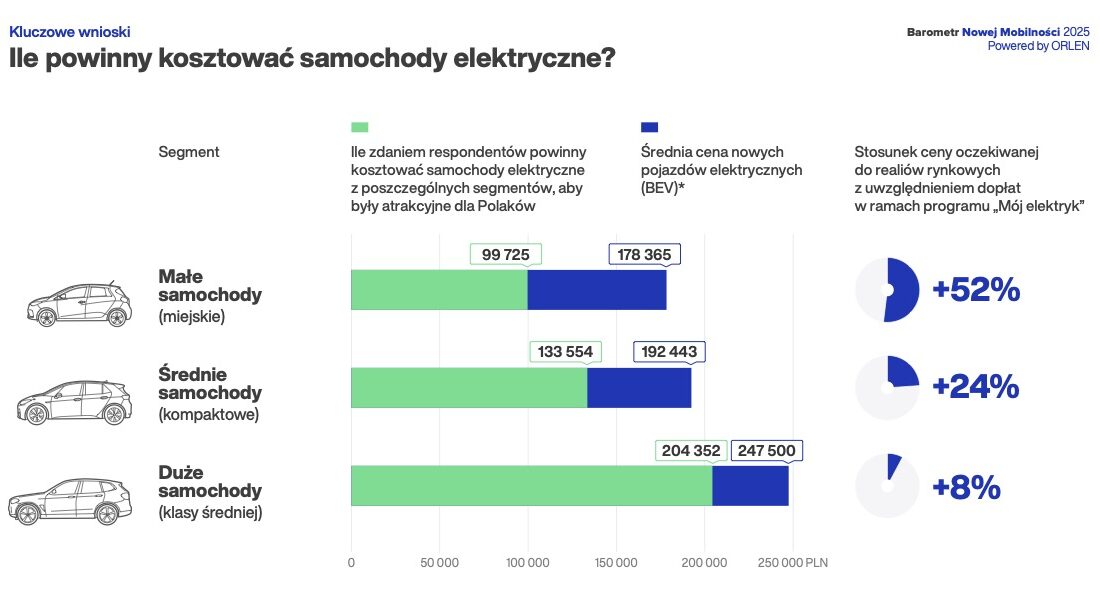

Over half of respondents (58%) state that lowering the prices of electric cars could effectively convince them to make a purchase. According to the survey, a city electric car should cost 99,725 PLN, while data from Info-Ekspert show that the average price of new vehicles in this segment is 178,365 PLN. For other segments, the gaps are smaller: respondents believe that compact cars should cost 133,554 PLN (the average price is 192,443 PLN), and mid-size cars 204,352 PLN (with an average price of 247,500 PLN).

– We have long known how important it is to tailor subsidies to the realities and accessibility for buyers. In a survey conducted for us by Minds & Roses in mid-2024—before the details of the Mój Elektryk 2.0 program were announced—OTOMOTO users indicated their interest in purchasing an electric car both in scenarios where they could benefit from subsidies and where such support was unavailable. Financial support increased the number of people considering buying an EV by as much as 22 percentage points compared to when no subsidies were available. This demonstrates that tangible financial assistance at the point of purchase is one of the key conditions for popularizing electromobility and gradually replacing conventional engine cars with EVs, comments Łukasz Juskowiak, Marketing Director at OTOMOTO.

Charging infrastructure as the key to the development of electromobility in Poland

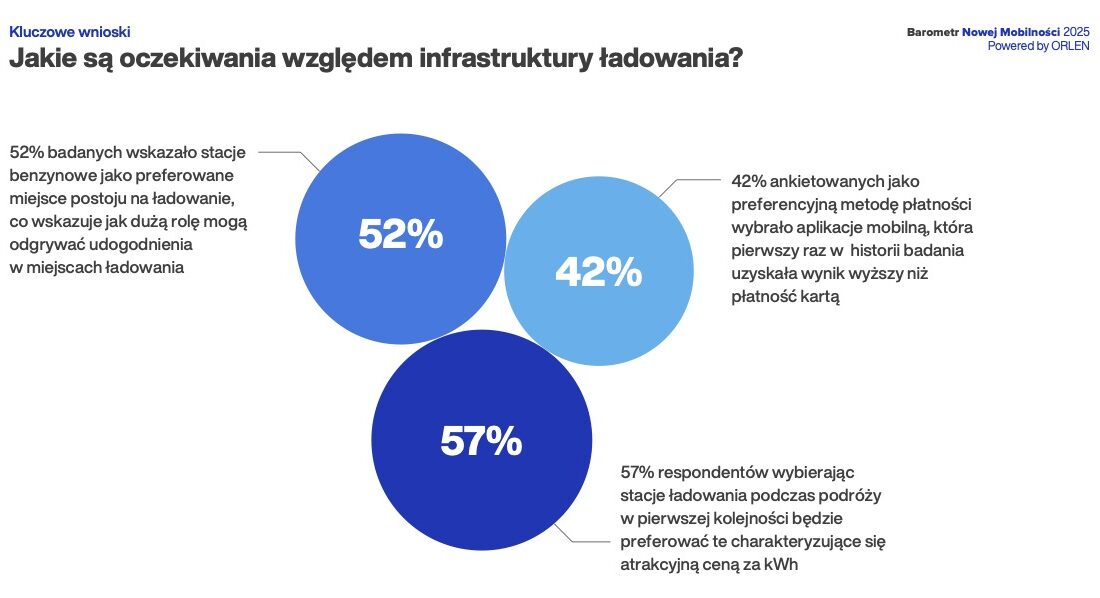

To convince Poles to adopt electromobility, vehicle prices alone must become more accessible. It is also essential to significantly accelerate the expansion of charging infrastructure. 33% of Poles consider this a priority and base their decision to purchase an EV on the state of the charging market. The latest PSNM report shows that Polish preferences regarding payment methods for charging services have changed. 42% of respondents now prefer using a mobile app, marking a breakthrough: for the first time in the history of the survey, card payments—which seven years ago accounted for over 80% of responses—fell to second place with 37%.

– According to this year’s edition of the New Mobility Barometer, 52% of respondents indicated fuel stations as their preferred place to stop for charging. Our activities and commitment to developing electromobility align with market demand. Currently, the ORLEN Charge network operates approximately 1,100 electric vehicle charging points in Poland, with existing DC (fast charging) stations mainly located at our fuel stations. Next year, we plan to commission several charging hubs along the TEN-T network, totaling over 100 charging points. In addition, we aim to build several additional single charging stations in urban areas, comments Marta Jaroni, Director of Operations and Electromobility Support Functions at ORLEN S.A.

Poles support ecological initiatives

An optimistic conclusion from the Barometer is the growing level of public support for climate protection measures. 44% of respondents support the implementation of clean transport zones in the cities where they live and travel. Respondents generally speak positively about the European Union’s actions: 43% view EU policy on transport decarbonization favorably, and 64% support the transition of urban bus fleets toward zero-emission vehicles.

The partners of the New Mobility Barometer powered by ORLEN 2025 are: ORLEN, OTOMOTO, PZU, as well as F5A and SW Research.

The full report will be available in the first quarter of 2025.