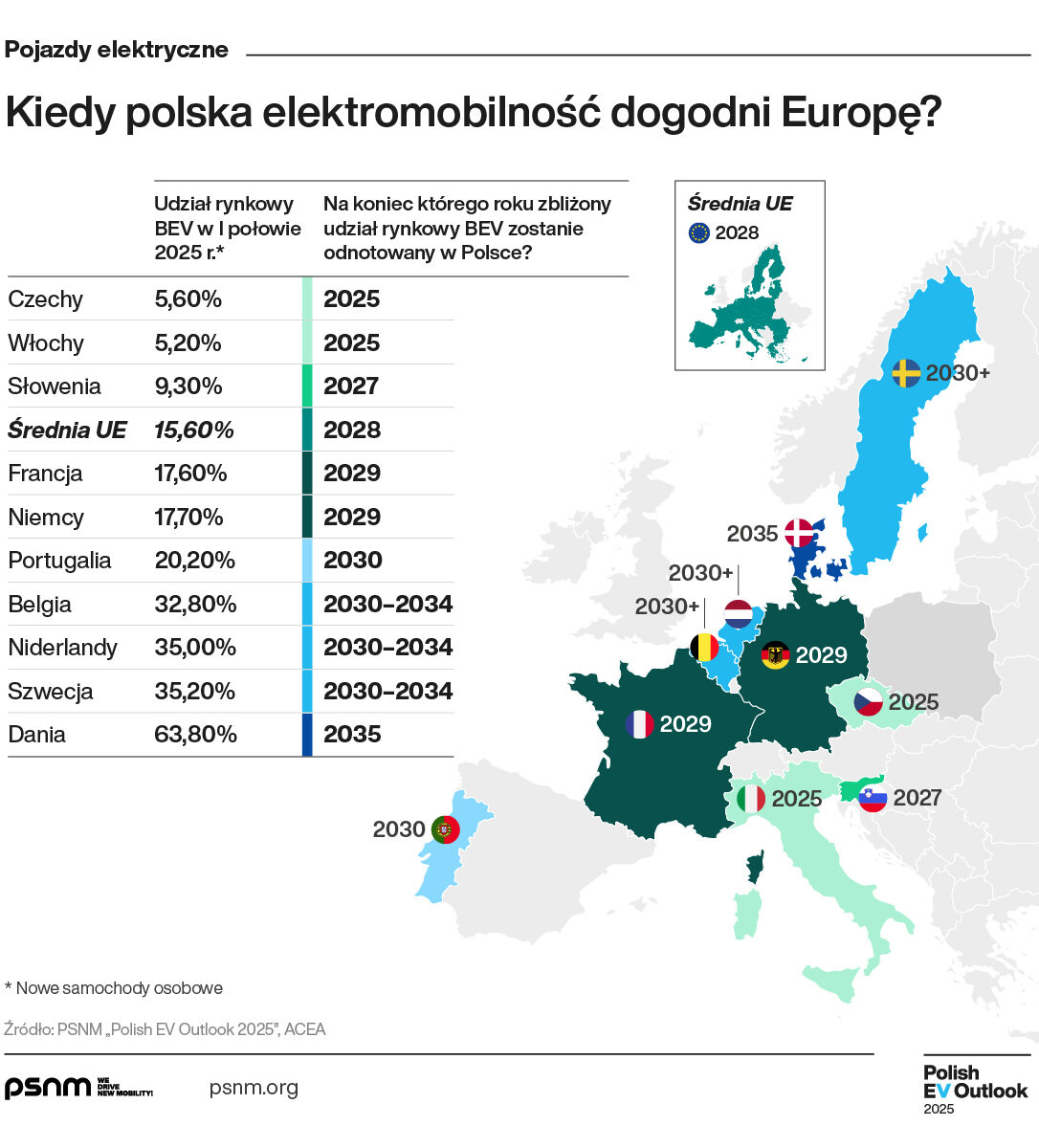

Less Than Four Years Separate Poland From Reaching the Current EU Average in Fully Electric Vehicle Registrations

Less than four years separate Poland from achieving the current European Union average level of fully electric vehicle (BEV) registrations, according to the latest edition of the cyclical “Polish EV Outlook” report prepared by PSNM and F5A. The year 2026 will be a critical point for the Polish market – marking the final period of public funding support. How will electromobility in Poland develop in the coming years?

The “Polish EV Outlook” is the most comprehensive analysis of the zero-emission transport market in Poland. The report provides a full overview of the electric passenger car, van, and truck sectors, along with development forecasts through 2040.

Poland’s electromobility sector is currently on an upward trajectory, especially compared to the previous year. The number of registered battery electric passenger vehicles (BEVs) in the first three quarters has more than doubled, with their market share in recent months reaching 8%. However, this still remains well below the current EU average. So when will the Polish market truly accelerate?

“We answer that question in the latest edition of the Polish EV Outlook through two alternative scenarios.

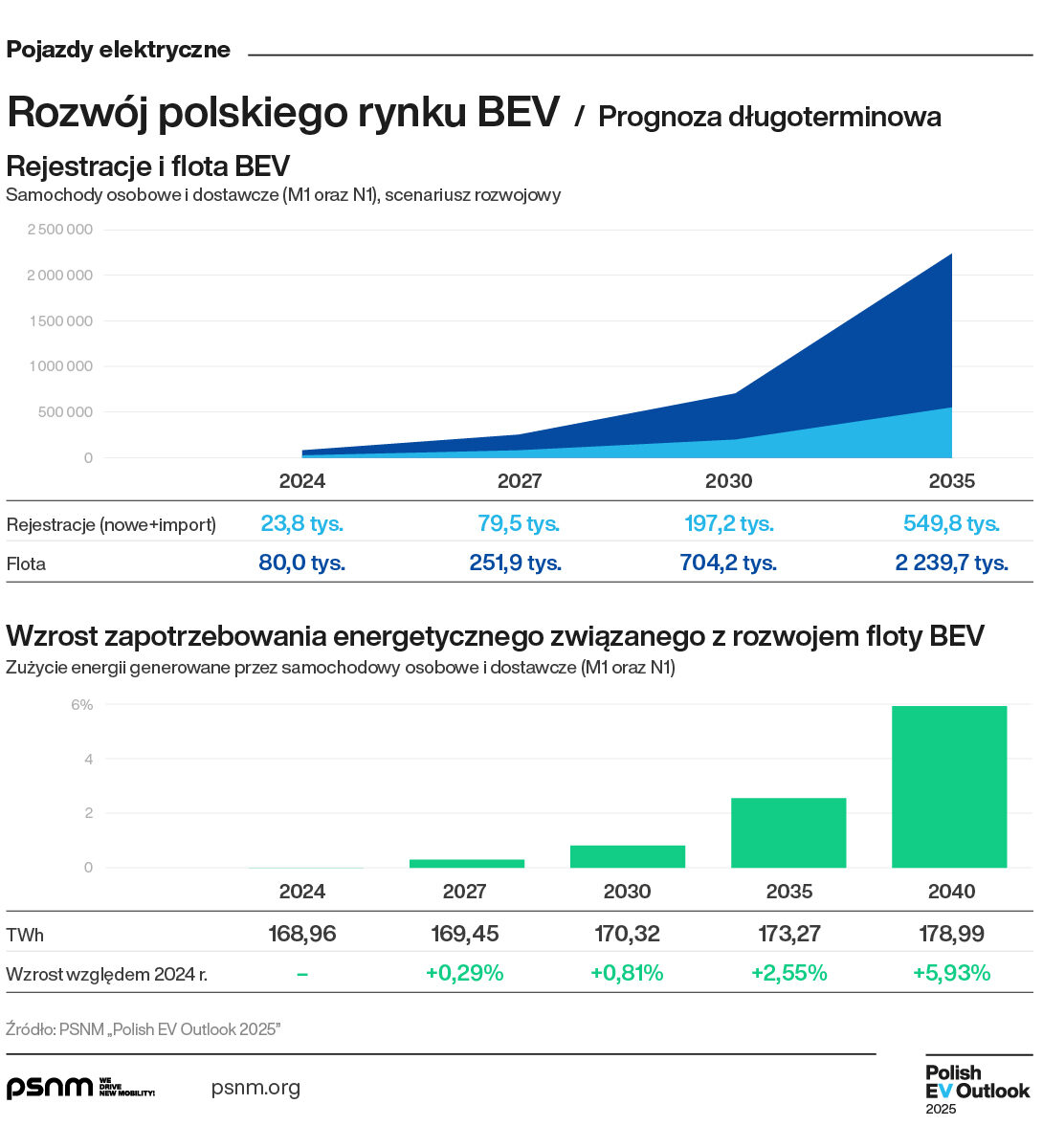

The more optimistic forecast – which assumes, among other things, broad optimization of the regulatory framework – projects that by 2030, the number of newly registered battery-electric passenger and light commercial vehicles could rise to around 197,000 per year, with over 700,000 BEVs on Polish roads. That’s almost seven times more than today.

The market share of BEVs in the passenger car segment could reach the current EU average in less than four years. By 2029, Poland’s share could be comparable to today’s levels in Germany or France. However, catching up with the European leaders, particularly Denmark, will not happen until 2035,”

says Jan Wiśniewski, Director of the Research and Analysis Center at PSNM.

At present, the key factor driving the growth in popularity of electric vehicles on the Polish market is the system of subsidies from the “NaszEauto” (OurEV) program. The end of the program in June 2026 is expected to lead to a temporary decline in BEV registrations.

“This decline is a natural phenomenon that we have already observed not only in Poland but also across many other European markets. After the drop in demand in the second half of 2026, the BEV segment will return to a growth path in 2027. This will be partly the result of the need to meet emission reduction targets under EU Regulation 2019/631. Automotive groups that fail to meet their minimum zero-emission vehicle sales quotas in 2025–2026 will have to make up for it in 2027.

Another key reason behind the projected rebound is the expansion of charging infrastructure and the narrowing price gap between ICE and BEV vehicles,”

explains Jan Wiśniewski, Director of the Research and Analysis Center at PSNM.

The numbers back this up. In the first half of 2025, the average weighted price of electric passenger cars sold on the Polish market was around 20% higher than that of internal combustion vehicles. A year earlier, the gap was as wide as 39%.

“The narrowing of this gap is due, among other factors, to rising prices of combustion-engine cars and growing interest among Poles in smaller (and more affordable) EVs. However, a real decline in BEV prices has also played an important role. For instance, the average weighted price of C-segment electric cars fell within a year from PLN 176,849 to just under PLN 174,748. The difference may seem modest, but it illustrates a trend that will increasingly support the development of electromobility in Poland in the coming months,”

says Albert Kania, Chief Operating Officer of F5A New Mobility Research and Consulting.

What else does the latest edition of Polish EV Outlook reveal?

Polish consumers prefer larger electric cars, far from the size of typical city vehicles. The D-segment remains the most popular on the Polish market, accounting for 28% of all registrations in 2025. However, this trend is beginning to shift — among popular segments, the largest increase in sales in 2025 was recorded in B-segment SUVs.

Electric cars in Poland are registered mainly by companies. In 2025, business customers accounted for around 82% of the BEV market — a slight decrease compared to last year, largely due to the rules of the NaszEauto program.

“The largest fleet of electric vehicles operates in Warsaw, where 23% of all fully electric cars in Poland are registered. Cities with populations between 300,000 and 1 million (Bydgoszcz, Lublin, Szczecin, Gdańsk, Poznań, Łódź, Wrocław, and Kraków) together account for 26%.

Looking at regions, the Mazowieckie voivodeship is the clear leader, with nearly 33,000 cumulative registrations – more than the next three regions combined (Wielkopolskie, Śląskie, and Małopolskie).

At the bottom of the ranking remain Warmińsko-Mazurskie (with only 1,370 registered BEVs in total), Opolskie, and Lubuskie,”

notes Albert Kania.

The “Polish EV Outlook” also includes, among other things, a forecast of the energy demand of Poland’s electric passenger car and van fleet through 2040. Contrary to many myths, the development of electromobility will not lead to a drastic increase in energy consumption. A BEV fleet that could reach 2.24 million vehicles by 2035 would increase energy demand by less than 2.6% compared to 2024 levels (169 TWh, according to PSE data).

In addition, the PSNM and F5A report provides a comprehensive set of data on Poland’s charging infrastructure, along with development forecasts for this sector through 2040. A significant portion is devoted to comparing market shares, network expansion, locations, and power capacity among various operators. The study also includes a detailed analysis of the e-mobility model offering, together with price trend changes on the BEV market. Moreover, it presents comprehensive data on the zero-emission heavy transport sector.

The “Polish EV Outlook” is available in a digital, cloud-based format powered by Power BI tools. As a result, the report provides unprecedented capabilities for data analysis, trend visualization, and forecast comparison. Through interactive dashboards, users can intuitively explore data, generate custom datasets, and access insights that support business decision-making.

More information about “Polish EV Outlook 2025”, as well as options for ordering the report, is available at: Polishevoutlook.pl