-

SNM summarizes 2024 in Poland’s new mobility sector.

The first-ever year-on-year decline in new electric vehicle registrations, a mere 3% BEV market share, and a very low level of compliance with EU AFIR requirements for charging infrastructure expansion are just some of the indicators of a challenging e-mobility market. -

Government actions have not improved the situation, including the premature end of the “My Electric 1.0” program and the suboptimal rules of the new “My Electric 2.0” program.

-

2024 also saw some positive developments: a record number of newly installed DC charging points, growth in urban new mobility, and preparation for the implementation of NFOŚiGW support programs with a combined budget of PLN 6 billion.

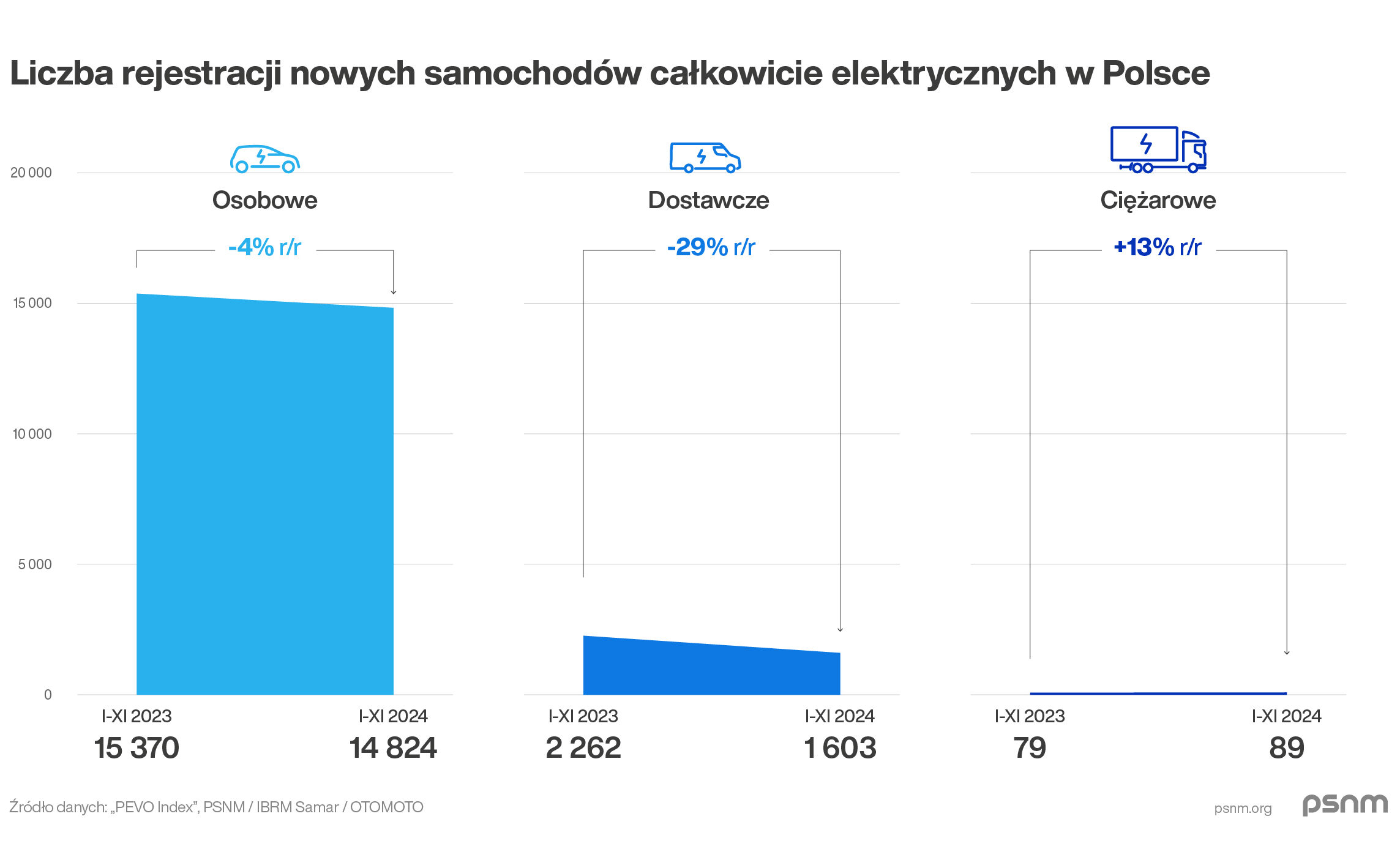

In 2024, for the first time, the number of new battery electric vehicle (BEV) registrations in Poland declined year-on-year. According to November data, the passenger EV segment fell by 3.5% YoY, while the light commercial vehicle segment dropped by as much as 29% YoY. The BEV share of the new passenger car market barely exceeds 3%, one of the lowest results in the European Union, ahead of only Croatia and Slovakia.

“2024 was a difficult, if not the most difficult, year in the short history of Poland’s new mobility sector. In many EU countries, after years of subsidies, markets have slowed slightly or stabilized — but this occurred at high sales volumes. In Poland, however, any decline should not have happened at this very early stage of sector development.

The unexpected decision first to suspend and then prematurely end the ‘My Electric’ program negatively impacted market growth. Until September, when subsidies still influenced registrations, we saw a year-on-year increase, small but still an increase. In recent months, however, the trend has been a continuous decline.

The state of the BEV market in 2024 stood in stark contrast to public charging infrastructure, which experienced significant growth. In just the first half of the year, the total charging capacity increased by nearly one-third, reaching around 300 MW — a record result,”

says Aleksander Rajch, Board Member of PSNM.

PSNM notes that replacing the previous support mechanism with the ‘My Electric 2.0’ program, which has many flaws and was not sufficiently consulted with social stakeholders, may slow the development of the market. Most importantly, there is a risk that the majority of the 1.6 billion PLN allocated to the program may be wasted.

Some hope for accelerating Poland’s e-mobility comes from the announced subsidy programs for electric trucks, related charging infrastructure, and power connections, which have a combined budget of 6 billion PLN. Their advanced implementation stage is, according to PSNM, one of the most positive developments in the Polish e-mobility market in 2024, and the rollout of these programs may bring Poland closer to achieving the goals of the EU AFIR regulation.

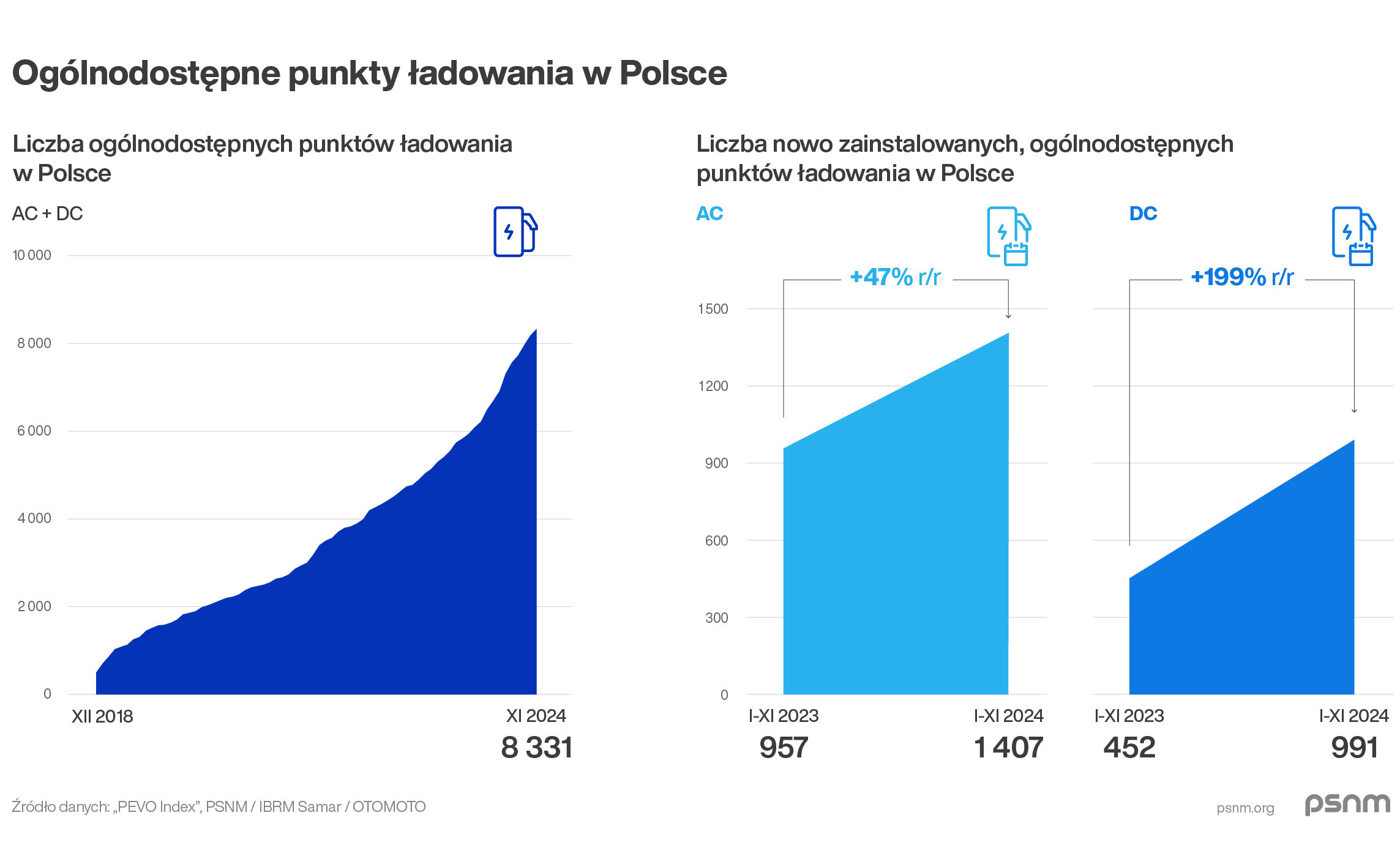

“We already know that 2024 will be record-breaking in terms of newly installed, publicly accessible charging points, especially in the key DC segment. During the first 11 months of this year, nearly 1,000 fast DC chargers were commissioned — more than twice the number compared to the same period in 2023.

This record is mainly thanks to the ambitious efforts of the industry, which continues to scale investments despite serious systemic barriers, lack of adequate support from public administration, and limited demand for charging services due to the still low share of EVs in the vehicle fleet. It is important to note that many of the points commissioned in 2024 were the completion of projects started months or even years earlier, often funded through now-ended support programs.

Currently, there are about 8,300 public charging points in Poland — far fewer than in Belgium (~80,000) or Austria (~30,000), countries with much smaller automotive markets than Poland,”

says Jan Wiśniewski, Director of the PSNM Research and Analysis Center.

PSNM points out that barriers to expanding charging infrastructure have led to a very low level of compliance with the EU AFIR regulation, which governs the development of charging zones along the TEN-T network and at urban hubs. Considering the core network and zones for light vehicles, AFIR obligations for 2025 and 2027 are currently met at only about 9% and 3.5%, respectively. For the comprehensive network and zones for heavy vehicles, compliance is effectively 0%. A further factor slowing infrastructure development is the unfavorable conditions of GDDKiA tenders.

“The development of the entire new mobility sector is still limited by prolonged and imperfect legislation. The central administration has yet to implement the vast majority of the 120 regulatory change proposals that PSNM and the industry prepared in the ‘White Paper on New Mobility.’ The Electromobility Act requires a comprehensive revision to align it with AFIR provisions — something we did not see in 2024. We are also still waiting for the transposition of the RED II directive into Polish law, while the RED III directive has already come into force at the EU level,” says Łukasz Witkowski, Vice President of PSNM.

PSNM emphasizes that in 2024, the Polish government still has not set clear economic development goals for the e-mobility sector, which are crucial for accelerating growth in production and R&D. There is no coherent, centrally defined strategy for transforming Poland’s automotive industry toward zero emissions. This poses a serious risk given global changes in the automotive sector and its significance for the Polish economy (the industry accounts for 8% of GDP, 13.5% of annual exports, and nearly half a million jobs).

“Failing to prioritize the new mobility industry means that Poland is not only losing development opportunities but also risks losing its current position, particularly in the battery sector. According to the Polish Economic Institute, from January to July 2024, the export value of lithium-ion batteries from Poland was €3.2 billion — a 58.2% year-on-year decrease. Signs of the challenging market situation included Northvolt ending energy storage production in Gdańsk and LG Energy Solution moving lithium-ion battery production for Ford EVs from Biskupice to the USA, due to more favorable financial conditions. At the same time, Poland is missing out on other potentially strategic investments, which are instead being located in other EU member states, including the CEE region. This is partly due to the still low share of renewable energy in the national energy mix,” says Aleksander Rajch, PSNM Board Member.

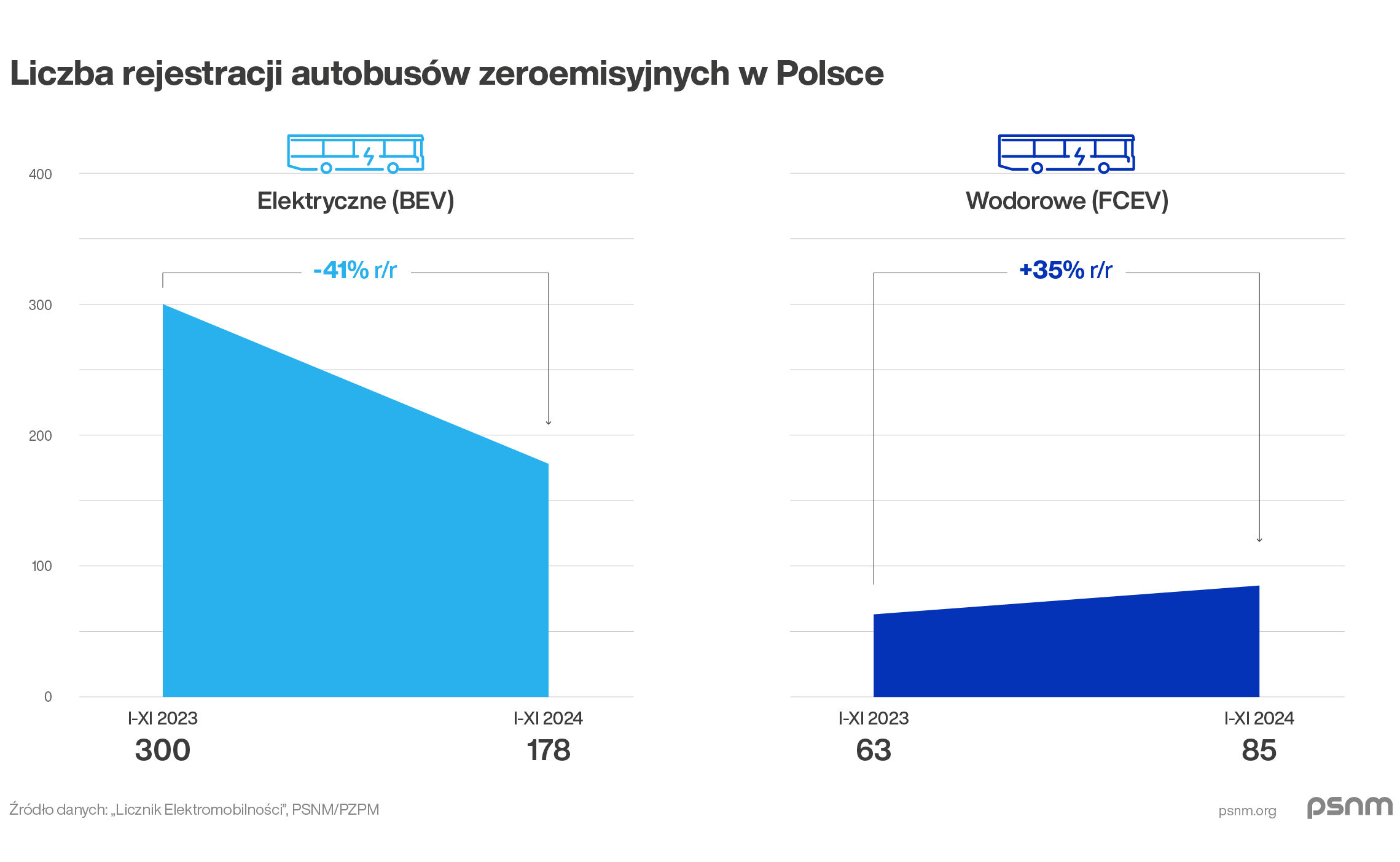

New mobility also faces significant challenges at the municipal level. In the first eleven months of 2024, there was a sharp decline in electric bus registrations. By the end of November, only 178 BEV e-buses were registered — 41% fewer than in the same period in 2023.

– in 2024, the local government sector also recorded a number of positive events and initiatives. above all, from july 1 this year, a clean transport zone (ctz) came into effect in warsaw. as a result, more than six years after the introduction of regulations governing ctzs into the polish legal system, poland now has its first such area, not counting the short-term ctz in krakow in 2019. soon, more ctzs will be implemented in polish cities. this is a result of the planned amendment to the act on electromobility and alternative fuels, which introduces the obligation to establish zones in cities with over 100,000 inhabitants where nitrogen oxide standards have been exceeded. the rapid development of urban bike systems is also encouraging. the number of such bikes has increased to over 27,400, representing a 28.2% year-on-year growth. this is partly due to the launch of two large and highly successful urban bike systems: the tri-city mevo system, offering 4,000 electric bikes, and metrorower, the largest system in poland and the third largest in europe – says agata wiśniewska-mazur, coordinator of the psnm local government committee.

however, the pace of charging infrastructure expansion in cities remains a problem. regardless of the sector-wide connection challenges, the biggest barriers include very lengthy approval procedures, architectural requirements that do not match market conditions (effectively preventing the opening of dc stations in some cities), and highly varied lease rates. as a result, in 19 of poland’s 37 largest cities, the share of publicly accessible fast dc charging points is no more than 20%, and in 11 of the 37 largest cities, the number of such points does not exceed 10. psnm emphasizes that the current scale of challenges at both national and local levels, declining ev registrations, barriers to infrastructure expansion, slow legislation, and a flawed funding system may put the polish market in an even more difficult position over the next 12 months.

– 2025 will greet us with a completely different regulatory reality. new emission reduction obligations will come into effect, forcing automakers to completely change the strategies they have pursued in recent months and once again focus on intensive electric vehicle sales. given that poland is near the bottom of the european e-mobility ranking, with evs making up only about 3% of the market, there is a significant risk that continued sluggish support for the new mobility market could turn the country into a primary market for combustion vehicles that nobody wants to buy elsewhere in europe. automakers will secure compliance with emission targets in other countries. as a result, the e-mobility market in poland could remain in a stagnation phase for a longer period. in the short term, this risk appears to be the biggest challenge currently facing stakeholders in the polish new mobility sector, but it is not yet too late to take preventive action – says maciej mazur, managing director of psnm.

the full psnm-prepared summary of 2024 in the polish new mobility sector is available in the report on their website: